Goldman Sachs Scales AI Coding to Thousands of Agents—3x Productivity Gains Expected

The Productivity Revolution Has a Date

Summary

Goldman deploys thousands of autonomous AI coders, projecting 3-4x productivity gains

First major bank scaling AI agents to potentially thousands alongside 12,000 developers

Industry-wide AI arms race accelerating - JPMorgan, Citi, BofA investing billions rapidly

Workforce evolution creating new high-value AI orchestration roles, massive productivity differentials

Productivity gaps this large reshape entire industries within 18 months

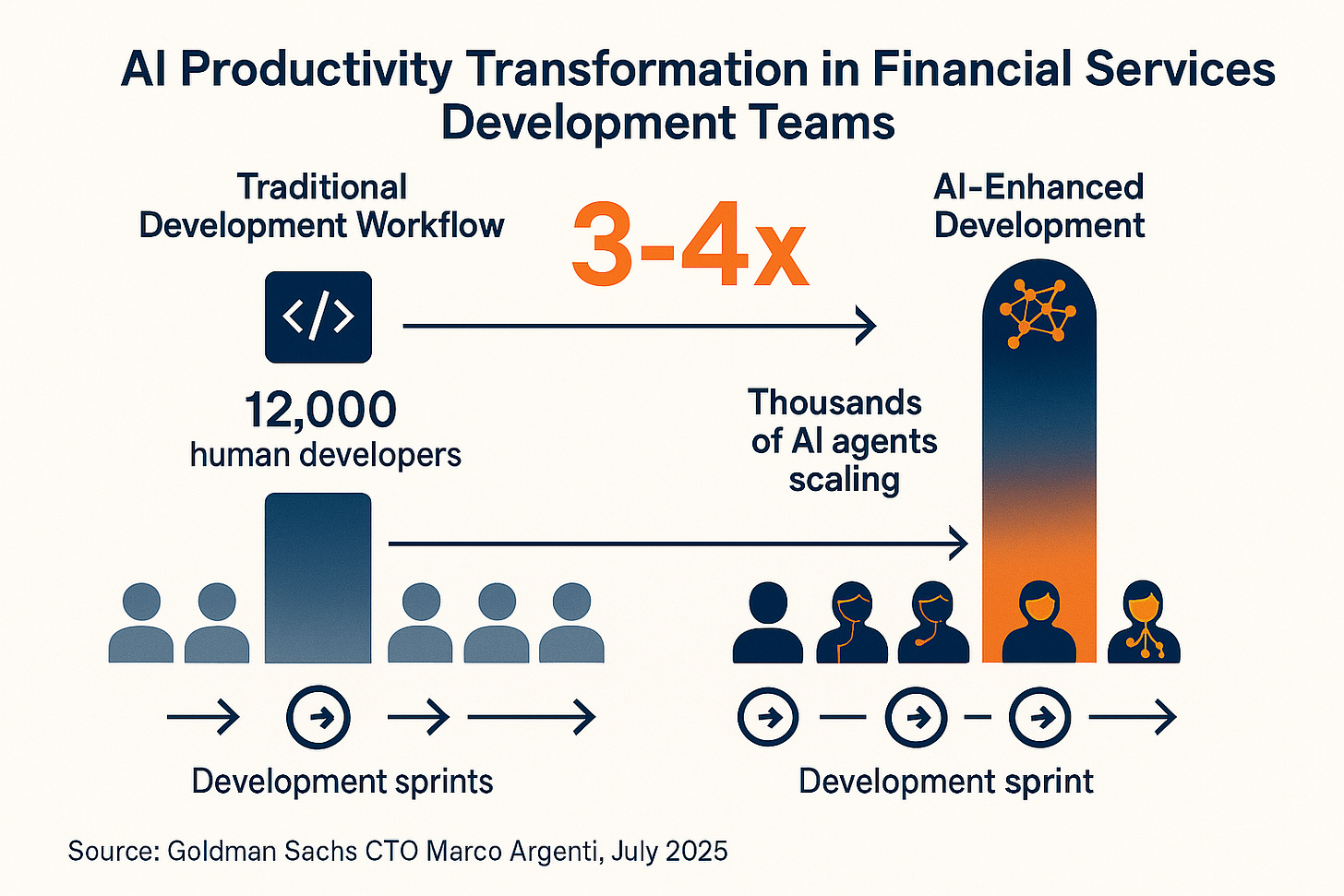

On July 11, 2025, Goldman Sachs announced plans to deploy thousands of autonomous AI software engineers—artificial intelligence agents that develop entire applications independently, working alongside the bank's nearly 12,000 human developers.[12] The bank expects to start with hundreds of AI agents and scale to potentially thousands, according to CTO Marco Argenti.[13]

The numbers reveal why this matters: Argenti projects these AI agents will boost worker productivity by three to four times compared to previous AI tools.[13] When a major investment bank can multiply its development capacity by 3-4x without hiring additional staff, every competitor faces an immediate strategic decision.

This isn't about being first to try AI coding—JPMorgan, Citigroup, and others are already there. This is about Goldman betting that autonomous AI agents can deliver productivity gains large enough to reshape how financial services operates.

The Strategic Foundation Was Already in Place

The indicators pointed toward this development for those monitoring the technology investment patterns. Earlier in 2025, Goldman CEO David Solomon demonstrated AI's immediate impact by revealing that artificial intelligence could complete 95% of an IPO prospectus "in minutes"—work that previously required a six-person team two weeks to finish.[1] "The last 5% now matters because the rest is now a commodity," Solomon observed, effectively signaling that most financial document creation had become a differentiated capability.[2]

JPMorgan Chase CEO Jamie Dimon had been even more direct in his 2024 shareholder letter, calling AI potentially "as transformational as some of the major technological inventions of the past several hundred years: Think the printing press, the steam engine, electricity, computing, and the Internet."[2]

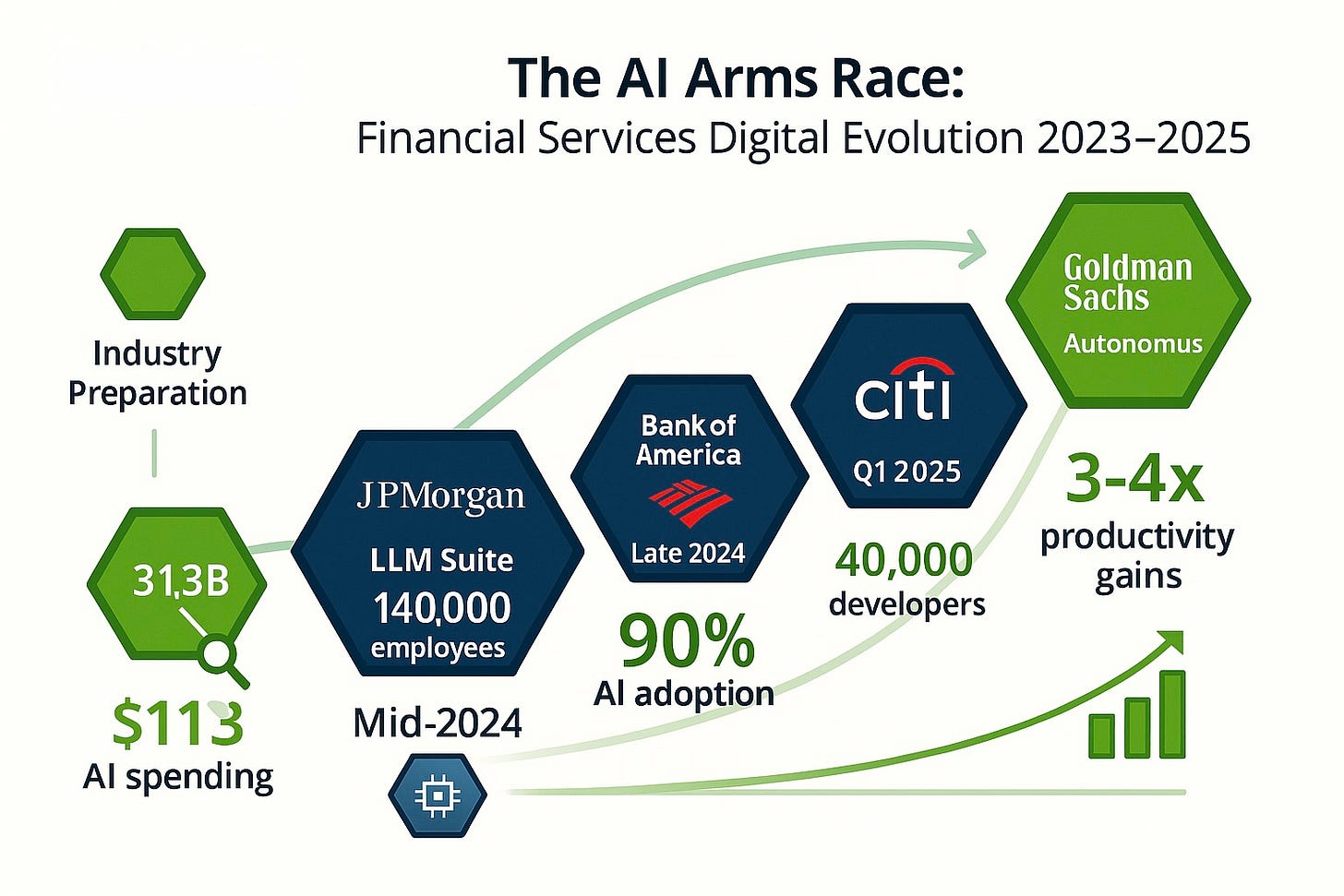

The investment data supported this strategic direction. By 2024, financial services became the second-largest AI spender globally at $31.3 billion.[3] Adoption accelerated from 37% of finance functions using AI in 2023 to 58% in 2024.[4] McKinsey projected generative AI could add $200-340 billion in value annually to global banking—equivalent to 2.8-4.7% of total industry revenues.[5]

This represented preparation for fundamental operational transformation rather than experimentation.

Strategic Implementation Accelerated Across Institutions

Throughout 2024, major banks prioritized AI deployment to maintain competitive positioning. JPMorgan Chase launched its LLM Suite in August, reaching 140,000 employees—nearly half its workforce—by September.[6] The bank allocated $18 billion to technology in 2025, with over 2,000 AI specialists working on 450+ use cases.[7]

Bank of America achieved 90% workforce adoption of AI tools by April 2025.[8] Their $4 billion AI investment delivered measurable results: over 50% reduction in IT service calls and 20%+ efficiency gains for developers.[9] CTO Aditya Bhasin declared: "AI is having a transformative effect on employee efficiency and operational excellence."[8]

Citigroup deployed GitHub Copilot to 40,000 developers, with early results showing 2x to 20x productivity improvements for specific tasks using autonomous agents versus traditional AI tools.[11] CTO David Griffiths explained the shift: "You can give the agentic AI a task, and the agentic AI will execute that task for you, so it can act as more of a proactive partner to a developer."[11]

Goldman's deployment of Devin represents the next evolution in institutional AI capabilities. Rather than incremental automation, this constitutes the first autonomous AI agent capable of handling complete software development lifecycles independently.

Devin was created by Cognition Labs, a startup founded in late 2023 that reached a $4 billion valuation in just over a year.[30][31] The company's backers include Peter Thiel and Joe Lonsdale—the same investors who funded Palantir and understood the power of giving machines human-level capabilities.[31]

Goldman is the first major bank to deploy Devin, though the bank doesn't own equity in Cognition.[30][32] That strategic distance suggests Goldman sees this as the beginning of a much larger transformation, not a one-off experiment.

The early results validate their bet. Tech giants are already seeing similar productivity explosions. Microsoft CEO Satya Nadella revealed that 20-30% of code in the company's repositories is now AI-generated.[33] Salesforce CEO Marc Benioff goes further, stating that AI handles 30-50% of all work at his company.[34]

But Goldman's move signals something more profound: the arrival of fully autonomous AI workers in the world's most conservative industry.

Implementation Results Demonstrate Viability

The immediate industry response validates the significance of Goldman's strategic move. Wells Fargo reported 245.4 million AI interactions in 2024, up from 21.3 million in 2023—representing over 1,000% growth as institutions accelerated implementation timelines.[14] Morgan Stanley achieved 98% adoption among financial advisor teams, improving document access efficiency from 20% to 80%.[15]

Regulatory bodies recognized they were witnessing a fundamental shift. Fed Governor Michelle Bowman acknowledged: "AI tools have the potential to substantially enhance the financial industry."[16] The Bank of England's 2024 survey found 75% of UK financial firms already using AI, up from 58% in 2022.[17]

Market data confirmed the transformation was real. Grand View Research valued the AI in banking market at $27.36 billion in 2024, projecting growth to $143.56 billion by 2030—a 31.8% compound annual growth rate.[18] The generative AI segment was growing even faster at 39.1% annually.[19]

But the human cost was becoming clear too.

Workforce Evolution and Value Creation

Bloomberg Intelligence's January 2025 analysis projects significant workforce restructuring as banks transform operations over the next 3-5 years.[20] Citigroup's assessment indicates 54% of banking jobs will be substantially enhanced or redefined through AI automation.[21]

The transformation demonstrates a pattern of value creation alongside role evolution. Organizations implementing AI effectively are expanding capabilities, accelerating service delivery, and creating new specialized positions focused on AI strategy, supervision, and innovation. The most technically proficient workers are experiencing increased demand and substantial compensation premiums as they transition to AI orchestration and strategic roles.

GitHub's 2024 research demonstrates this productivity multiplication effect: 97% of developers using AI tools report up to 55% productivity increases for early adopters.[22] Atlassian's 2025 report shows 99% of developers gaining time savings, with 68% saving more than 10 hours weekly—time that can be redirected toward higher-value strategic work.[23] IBM's study indicates 34% of financial services workers will require reskilling for newly created AI-enhanced roles.[24]

The Emerging Operational Model

Goldman's deployment of Devin reveals the value-creation hierarchy emerging across financial services. Routine development work becomes automated, freeing human capacity for strategic innovation. Traditional developers can demonstrate enhanced value by focusing on complex problem-solving, client interaction, and system architecture. A growing tier of AI orchestration specialists achieves substantially enhanced productivity while creating new forms of strategic value for their institutions.

As Marco Argenti explained Goldman's vision: "It's really about people and AIs working side by side. Engineers are going to be expected to have the ability to really describe problems in a coherent way and turn it into prompts... and then be able to supervise the work of those agents."[25] This collaborative model amplifies human strategic thinking while automating routine execution.

The expansion potential extends beyond coding. Argenti noted that other banking functions will benefit from similar AI enhancement as the technology proves its value. "Those models are basically just as good as any developer," he observed. "So I think that will serve as a proof point also to expand it to other places."[25] This suggests widespread productivity gains across multiple business functions.

Strategic Outlook and Implementation Timeline

The next 12-24 months will determine which financial institutions successfully transition to AI-enhanced operations. Based on current implementation patterns, several developments appear inevitable:

Near-term (6 months): Major banks will announce autonomous AI agent deployments. Productivity differentials between AI-enabled and traditional institutions will create measurable competitive advantages in client service delivery, enabling expanded service offerings and enhanced client experiences.

Medium-term (6-18 months): Traditional entry-level roles will evolve toward AI collaboration and supervision. Universities will accelerate curriculum development for emerging AI orchestration positions. Mid-career professionals will access new high-value roles requiring hybrid human-AI expertise.

Longer-term (1-2 years): AI agents will handle routine interactions and analysis, while human professionals focus on complex client relationships, strategic decision-making, and innovative solution development. This division of labor will enable institutions to serve more clients with higher-quality, more personalized service.

Goldman Sachs' deployment of Devin establishes the precedent for autonomous AI integration in financial services. As Argenti emphasized, they are implementing "a hybrid workforce where humans and AI coexist."[25] This operational model represents the near-term future for the industry.

The strategic opportunity facing financial services leaders is how quickly they can implement autonomous AI capabilities to multiply their teams' productivity, expand service capabilities, and create new value propositions while developing the human expertise needed to orchestrate these enhanced systems effectively.

References

Fortune. "Goldman Sachs CEO says that AI can draft 95% of an IPO prospectus in minutes." January 17, 2025. https://fortune.com/2025/01/17/goldman-sachs-ceo-david-solomon-ai-tasks-ipo-prospectus-s1-filing-sec/

The Motley Fool. "JPMorgan Chase CEO Jamie Dimon Says Artificial Intelligence (AI) Could Be as Transformational as the Printing Press, Steam Engine, Electricity, Computing, and the Internet." April 11, 2024. https://www.fool.com/investing/2024/04/11/jpmorgan-ceo-jamie-dimon-says-ai-could-be/

IDC Blog. "IDC's Worldwide AI and Generative AI Spending – Industry Outlook." August 21, 2024. https://blogs.idc.com/2024/08/21/idcs-worldwide-ai-and-generative-ai-spending-industry-outlook/

The CFO. "58% of finance functions using AI in 2024 - Gartner research." September 11, 2024. https://the-cfo.io/2024/09/11/58-of-finance-functions-using-ai-in-2024-gartner-research/

McKinsey & Company. "The Economic Potential of Generative AI: The Next Productivity Frontier." June 2023.

CNBC. "JPMorgan Chase is giving its employees an AI assistant powered by ChatGPT maker OpenAI." August 9, 2024. https://www.cnbc.com/2024/08/09/jpmorgan-chase-ai-artificial-intelligence-assistant-chatgpt-openai.html

JPMorgan Chase. "2024 Annual Report and Form 10-K." 2024.

Bank of America. "AI Adoption by BofA's Global Workforce Improves Productivity, Client Service." April 2025. https://newsroom.bankofamerica.com/content/newsroom/press-releases/2025/04/ai-adoption-by-bofa-s-global-workforce-improves-productivity--cl.html

Bank Automation News. "AI could reduce turnover in 2024, Bank of America CEO says." 2024. https://bankautomationnews.com/allposts/ai/ai-could-reduce-turnover-in-2024-bank-of-america-ceo-says/

Voicebot.ai. "Cognition Labs Claims $2B Valuation After 6 Months and $175M Investment in Generative AI Coding Assistant Devin." April 25, 2024. https://voicebot.ai/2024/04/25/cognition-labs-claims-2b-valuation-after-6-months-and-175m-investment-in-generative-ai-coding-assistant-devin/

American Banker. "Citi is rolling out agentic AI to its 40,000 developers." 2024. https://www.americanbanker.com/news/citi-is-rolling-out-agentic-ai-to-its-40-000-developers

CNBC. "Goldman Sachs is piloting its first autonomous coder in major AI milestone for Wall Street." July 11, 2025. https://www.cnbc.com/2025/07/11/goldman-sachs-autonomous-coder-pilot-marks-major-ai-milestone.html

VentureBeat. "Wells Fargo's AI assistant just crossed 245 million interactions – no human handoffs, no sensitive data exposed." 2024. https://venturebeat.com/ai/wells-fargos-ai-assistant-just-crossed-245-million-interactions-with-zero-humans-in-the-loop-and-zero-pii-to-the-llm/

Morgan Stanley. "Morgan Stanley Wins Three 2024 Technology Awards." 2024. https://www.morganstanley.com/press-releases/morgan-stanley-wins-three-2024-technology-awards

Federal Reserve. "Speech by Governor Bowman on artificial intelligence in the financial system." November 22, 2024. https://www.federalreserve.gov/newsevents/speech/bowman20241122a.htm

Global Government Fintech. "BoE launches 'AI Consortium' as new external engagement." 2024. https://www.globalgovernmentfintech.com/bank-of-england-ai-consortium-launches/

Grand View Research. "Artificial Intelligence In Banking Market Size Report, 2030." 2024. https://www.grandviewresearch.com/industry-analysis/artificial-intelligence-banking-market-report

Grand View Research. "Generative AI In Financial Services Market Size Report, 2030." 2024. https://www.grandviewresearch.com/industry-analysis/generative-ai-financial-services-market-report

Bloomberg. "Wall Street Expected to Shed 200,000 Jobs as AI Erodes Roles." January 9, 2025. https://www.bloomberg.com/news/articles/2025-01-09/wall-street-expected-to-shed-200-000-jobs-as-ai-erodes-roles

Bloomberg. "AI Is Likely to Displace More Finance Jobs Than Any Other Sector, Citi Says." June 19, 2024. https://www.bloomberg.com/news/articles/2024-06-19/citi-sees-ai-displacing-more-finance-jobs-than-any-other-sector

GitHub. "Survey: The AI wave continues to grow on software development teams." 2024. https://github.blog/news-insights/research/survey-ai-wave-grows/

Atlassian. "Atlassian research: AI adoption is rising, but friction persists." 2025. https://www.atlassian.com/blog/developer/developer-experience-report-2025

IBM. "IBM Study: Banking and Financial Markets CEOs are Betting on Generative AI to Stay Competitive, Yet Workforce and Culture Challenges Persist." June 5, 2024. https://newsroom.ibm.com/2024-06-05-IBM-Study-Banking-and-Financial-Markets-CEOs-are-betting-on-generative-AI-to-stay-competitive,-yet-workforce-and-culture-challenges-persist

CNBC. "Goldman Sachs is piloting its first autonomous coder in major AI milestone for Wall Street." July 11, 2025.

TechCrunch. "Goldman Sachs is testing viral AI agent Devin as a 'new employee'." July 11, 2025. https://techcrunch.com/2025/07/11/goldman-sachs-is-testing-viral-ai-agent-devin-as-a-new-employee/

Qz. "Goldman Sachs adds AI coder Devin to its headcount." July 11, 2025. https://qz.com/goldman-sachs-ai-coder-devin-cognition

Fast Company. "Meet Devin: Goldman Sachs's new AI software engineer that never sleeps." July 11, 2025. https://www.fastcompany.com/91366706/meet-devin-goldman-sachs-new-ai-software-engineer-that-never-sleeps

Open Data Science. "Goldman Sachs Becomes First Major Bank to Use AI Agent Devin, Signaling Shift Toward Hybrid Workforce." July 11, 2025. https://opendatascience.com/goldman-sachs-becomes-first-major-bank-to-use-ai-agent-devin-signaling-shift-toward-hybrid-workforce/

CNBC. "Goldman Sachs is piloting its first autonomous coder in major AI milestone for Wall Street." July 11, 2025. https://www.cnbc.com/2025/07/11/goldman-sachs-autonomous-coder-pilot-marks-major-ai-milestone.html

TechCrunch. "Microsoft CEO says up to 30% of the company's code was written by AI." April 30, 2025. https://techcrunch.com/2025/04/29/microsoft-ceo-says-up-to-30-of-the-companys-code-was-written-by-ai/

Bloomberg. "Salesforce CEO Says 30% of Internal Work Is Being Handled by AI." June 26, 2025. https://finance.yahoo.com/news/salesforce-ceo-says-30-internal-121536694.html