The Three-Speed Race: Why AI Credit Risk Creates Winners, Survivors, and Casualties

From Desolation Row to Differentiation: The Three-Speed Economy That's Leaving Some Firms Way Behind

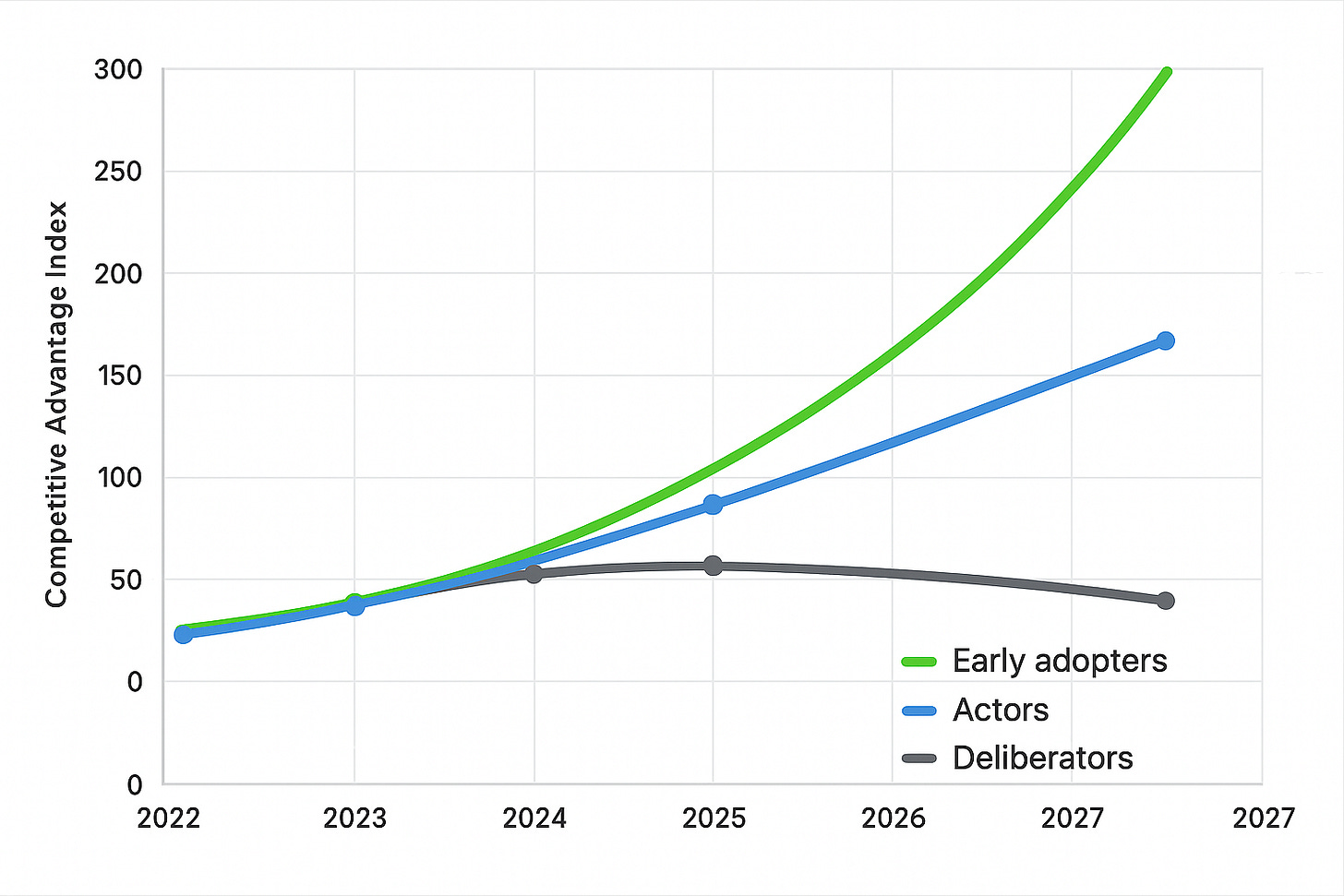

Twenty percent of financial institutions have implemented AI in credit risk. Eighty percent haven't. The advantages the twenty percent gain compound daily - better decisions, more customers, lower costs, stronger moats. This analysis examines why the gap is widening faster than the eighty percent realize, and what they can still do about it.

UK banks using AI approve 77% more loans at the same risk level [17]. American Express prevents $2 billion in annual fraud [10, 11]. Commonwealth Credit Union achieves 30-40% lower delinquency ratios [22, 23]. These are a long way from projections - they're current results creating permanent competitive advantages. The market has split into three groups [1], and the gaps between them widen daily.

McKinsey's survey of 24 major financial institutions reveals the market has split into three camps: Early Adopters (20%) who've implemented AI and are compounding advantages daily, Actors (roughly 30%) racing to move from pilots to production, and Deliberators (approximately 50%) still discussing whether to begin [2]. The strategic question isn't whether AI works in credit risk - that debate ended eighteen months ago. The question is simpler: which group are you in, and what are you going to do about it?

The Three-Speed Economy Takes Shape - The Circus Is in Town

Financial services now operates at three distinct speeds, and the gaps between them widen every day. This is far from speculation - it's measurable reality documented across hundreds of implementations. The circus is in town, and everyone's choosing their act.

The Early Adopters (20%): JPMorgan Chase processes millions of transactions through 450+ AI use cases. American Express prevents $2 billion in annual fraud with millisecond decisions. Commonwealth Credit Union approves 15% more loans at lower risk. They're not experimenting - they're operating in a different competitive universe [8][10][22].

The Actors (~30%): These institutions have moved beyond pilots to implementation. They're not catching up to Early Adopters - they're trying to prevent the gap from becoming insurmountable. Every week of delay costs them customers, data, and competitive position. They know they're behind, but at least they're moving.

The Deliberators (~50%): Still in committees. Still requesting more analysis. Still believing that careful consideration equals risk management. They're not being prudent - they're choosing to operate with yesterday's tools while their customers leave for tomorrow's experience.

Here's the uncomfortable truth: you know exactly which group your business is in. The question is for many firms is whether they'll do something about it before the gaps become permanent.

They're Selling Postcards of the Hanging

The AI vendor circus has arrived in full force. Every consultancy, technology firm, and startup promises revolutionary transformation. The market has become saturated with solutions ranging from genuinely transformative to purely theatrical. Major consulting firms package AI strategies despite limited real-world implementation experience. Technology giants rebrand existing analytics as "AI-powered" without fundamental innovation.

Meanwhile, nimble startups flood the market with point solutions that may solve narrow problems but lack enterprise scale. This cacophony of vendors creates a paradox: while the need for AI transformation is urgent and real, the noise makes it increasingly difficult to identify solutions that deliver genuine business value. The challenge isn't finding AI vendors—it's distinguishing between those selling genuine transformation and those simply capitalizing on market anxiety.

All the Agents and the Superhuman Crew

The Big Consultancies package their limited understanding as expertise, selling "AI transformation roadmaps" to banks that naturally understand their own businesses better than any consultant could. The irony is rich: firms that struggled to predict mobile banking now position themselves as AI oracles.

But buried in the hype are real results that separate marketing from reality. UK high street banks using Kortical's AutoML platform achieve 83% catch rates for bad debt missed by traditional credit scores [17]. They're lending to 77% more people while maintaining the same default rate [17]. This isn't theoretical - it's happening now, at scale.

The numbers that matter:

30% improvement in default prediction accuracy [3][4][5]

50% reduction in fraud losses [19][21]

91% loan processing automation [33]

15-minute decisions versus 7-17 days [53][54]

American Express processes $1.2 trillion annually with fraud rates half their competitors [10][11]. They uncover $2 billion in potential fraud incidents yearly with systems making decisions in 2 milliseconds - 50x faster than CPU-based configurations [10]. This is what real implementation looks like, not vendor promises.

Nobody Has to Think Too Much About Desolation Row

The Deliberators have mastered the art of productive procrastination. Another committee meeting. Another vendor evaluation. Another request for ROI projections. They're sophisticated in their avoidance, using governance concerns and regulatory uncertainty as shields against uncomfortable truths.

But while they deliberate, the market moves:

Fintech lenders using AI grow at 25-26% CAGR versus traditional banks' single digits [37]

Shadow banks increased lending volume 405% since 2009 [41]

The AI lending market explodes from $7 billion to $58 billion by 2033 [38][39]

Alternative data enables scoring for 1.4 billion previously "invisible" borrowers [24][25]

The comfortable delusion is that waiting reduces risk. The uncomfortable reality is that every day of delay increases competitive disadvantage. Customers Bank grew from $250 million to $18 billion in assets through AI partnerships [43]. During the same period, how many committees did their competitors hold?

And the Riot Squad, They're Restless

Here's what Deliberators miss: the advantages of early adoption compound exponentially, not linearly. While they debate, the riot squad of competitors grows restless, pushing further ahead with each passing quarter.

Data Network Effects: Each loan decision improves the next. JPMorgan's 200,000 employees using AI tools generate training data that improves models daily [8]. Late adopters can't buy historical data - they can only start accumulating it after implementation.

Customer Acquisition Costs: When you can approve 77% more applicants at the same risk level, customer acquisition costs plummet [17]. Early Adopters are buying market share at prices Deliberators can't match.

Operational Leverage: BNP Paribas targets €500 million in AI-generated revenue with 10-15% bottom-line improvement [51][52]. These aren't efficiency gains - they're structural cost advantages that compound quarterly.

Talent Concentration: The 17% growth in AI workforce concentrates in the 20% of Early Adopters [65]. The best people want to work with the best tools. Deliberators face a talent crisis that worsens daily.

Right Now I Can't Read Too Good

The analysis paralysis affecting Deliberators has reached comic proportions. Another McKinsey report lands on the desk. Another vendor pitch promises transformation. Another conference on "The Future of AI in Finance." But information isn't the problem - action is.

The implementation timeline tells the real story:

Weeks 1-4: API integration and basic automation deliver quick wins [30]

Months 1-2: Foundation building and model training [31]

Months 3-6: Alternative data integration and compliance frameworks [31]

Months 6-12: Full optimization and production deployment [30]

While Deliberators debate whether to start, Early Adopters complete entire implementation cycles. The tools exist. The blueprints are proven. The only variable is will.

The Alternative Data Moat - Einstein, Disguised as Robin Hood

The integration of alternative data sources - social media patterns, utility payments, mobile phone usage, e-commerce behavior - creates competitive moats that deepen daily. AI takes the wealth of data from traditional scoring monopolies and redistributes from credit access to agile hedge funds and asset managers as well as fintechs and technology-first lenders.

Experian Boost users see average credit score increases of 13 points from utility payment history [26]. In New York City, 28% of residents gained credit scores for the first time through rental payment inclusion [28]. Mobile phone data predicts credit risk with 85% accuracy [24]. The alternative data market grows from $11 billion to $135.8 billion by 2030 [29].

But here's what matters: these data sources create proprietary advantages. Relationships with data providers solidify. Historical performance data accumulates. Models trained on unique datasets become impossible to replicate. Every day of delay doesn't just mean falling behind - it means the leaders are building moats you'll never cross.

The Customer Experience Chasm - Cinderella, She Seems So Easy

The gap between AI-powered and traditional credit experiences isn't closing - it's exploding. AI systems make decisions in seconds using 1,600+ variables [59]. Traditional processes take days or weeks using dozens of factors. AI makes everything seem so easy for customers while traditional banks keep them waiting at the ball.

Real implementation results:

Application processing time: down 70% [62]

Document processing accuracy: up to 95% [63]

Customer satisfaction in collections: up 30% [61]

Cross-sell success rates: up 15% [55][56]

Wells Fargo's Fargo Assistant handled 245 million interactions in 2024, up from 21.3 million in 2023 [16]. This isn't linear growth - it's exponential adoption that resets customer expectations permanently. Once customers experience instant, accurate decisions, they don't go back to waiting.

The Path from Deliberator to Actor to Adopter - Get Out of the Doorway

The progression between groups isn't mysterious - it's a series of concrete actions that separate intent from results. The message is simple: get out of the doorway and start moving.

Deliberator to Actor (The Critical Leap):

Stop commissioning studies. Start running pilots.

Pick one use case: fraud detection or credit scoring

Allocate budget and team. Not committee - team.

Set a 90-day deadline for production pilot

Accept that version 1.0 won't be perfect

Actor to Early Adopter (The Acceleration):

Move from pilot to platform

Integrate alternative data sources

Expand from single use case to portfolio approach

Build internal capabilities, don't just buy vendor solutions

Make AI enhancement the default, not the exception

The tragedy isn't that Deliberators can't become Early Adopters. It's that they're choosing not to, one committee meeting at a time.

The Blind Commissioner's in a Trance

The perfectionist trap killing Deliberators is the belief that AI must be flawless before deployment. Governance committees demand perfect explanations from AI while accepting mediocre performance from humans.

Commonwealth Credit Union didn't achieve 30-40% lower delinquency ratios by waiting for perfection [22]. They started with "good enough" and improved through iteration.

The mathematics are unforgiving:

85% accurate AI beating 60% accurate manual processes: implement now

92% AI accuracy improving monthly versus 74% human accuracy stagnating: implement now

$4 billion in prevented fraud versus theoretical governance risks: implement now

The safest thing you can do is implement AI aggressively. The riskiest thing is your current "cautious" approach. Markets don't reward the careful - they reward the capable.

The Monday Morning Question - Which Side Are You On?

American Express processes $1.2 trillion annually with fraud detection decisions made in 2 milliseconds - 50x faster than CPU-based configurations [10]. Wells Fargo's AI assistant handled 245 million interactions in 2024, up from 21.3 million in 2023 [16]. While Deliberators debate, Early Adopters are operating at a fundamentally different speed and scale.

Which side are you on? The question echoes through every boardroom, every technology committee, every strategic planning session. The classification is complete: Early Adopters building moats, Actors racing to catch up, Deliberators debating while customers leave.

The strategic imperative is unambiguous:

If you're an Early Adopter: Press your advantage. The moat-building phase has begun.

If you're an Actor: Accelerate. So that the gap to Early Adopters doesn’t widen faster than you're closing it.

If you're a Deliberator: Monday morning, not Monday month. Pick a use case and start.

The tools exist. The blueprints are proven. The results are documented. The only question is whether you'll act on what you already know to be true: in the three-speed economy of financial services, standing still is moving backward, and moving slowly is falling behind.

You know which side you're on. The only question that matters: what are you going to do about it?

References

[1] "Embracing generative AI in credit risk" - McKinsey & Company https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/embracing-generative-ai-in-credit-risk

[2] "Embracing generative AI in credit risk" - McKinsey.org https://www.mckinsey.org/capabilities/risk-and-resilience/our-insights/embracing-generative-ai-in-credit-risk

[3] "The Role Of AI And ML In Transforming Credit Risk Management In Banking" - Avenga https://www.avenga.com/magazine/ai-for-credit-risk-management/

[4] "How AI is Transforming Credit Risk Management?" - HighRadius https://www.highradius.com/resources/Blog/ai-in-credit-risk-management/

[5] "AI Credit Scoring: The Future of Credit Risk Assessment" - Datrics https://www.datrics.ai/articles/the-essentials-of-ai-based-credit-scoring

[6] "JPMorgan says AI helped boost sales, add clients in market turmoil" - Reuters https://www.reuters.com/business/finance/jpmorgan-says-ai-helped-boost-sales-add-clients-market-turmoil-2025-05-05/

[7] "Goldman Sachs launches AI assistant as the tech sweeps banking" - CNBC https://www.cnbc.com/2025/01/21/goldman-sachs-launches-ai-assistant.html

[8] "JPMorgan says AI helped boost sales, add clients in market turmoil" - Reuters https://www.reuters.com/business/finance/jpmorgan-says-ai-helped-boost-sales-add-clients-market-turmoil-2025-05-05/

[9] "Goldman Sachs launches AI assistant as the tech sweeps banking" - CNBC https://www.cnbc.com/2025/01/21/goldman-sachs-launches-ai-assistant.html

[10] "Artificial Intelligence at American Express - Two Current Use Cases" - Emerj https://emerj.com/artificial-intelligence-at-american-express/

[11] "3 Ways American Express is Using AI to Stay Ahead of Disruption" - Aidata Analytics https://www.aidataanalytics.network/data-science-ai/articles/3-ways-american-express-is-using-ai-to-stay-ahead-of-disruption

[12] "5 ways American Express is using AI - Case Study [2025]" - DigitalDefynd https://digitaldefynd.com/IQ/american-express-using-ai-case-study/

[13] "Artificial Intelligence at Wells Fargo- Two Use Cases" - Emerj https://emerj.com/artificial-intelligence-at-wells-fargo-two-use-cases/

[14] "Bank of America's big bet on AI started small" - CIO https://www.cio.com/article/3966293/bank-of-americas-big-bet-on-ai-started-small.html

[15] "Generative AI In Banking: 7 Use Cases And Challenges In 2025" - Ideas2IT https://www.ideas2it.com/blogs/generative-ai-in-banking

[16] "Wells Fargo's AI assistant just crossed 245 million interactions" - VentureBeat https://venturebeat.com/ai/wells-fargos-ai-assistant-just-crossed-245-million-interactions-with-zero-humans-in-the-loop-and-zero-pii-to-the-llm/

[17] "Explainable AI for Credit Assessment in Banks" - MDPI https://www.mdpi.com/1911-8074/15/12/556

[18] "The Role of Artificial Intelligence in Income Verification" - Snappt https://snappt.com/blog/income-verification-ai/

[19] "American Express: Using Big Data to Prevent Fraud" - Harvard D3 https://d3.harvard.edu/platform-digit/submission/american-express-using-big-data-to-prevent-fraud/

[20] "5 ways American Express is using AI - Case Study [2025]" - DigitalDefynd https://digitaldefynd.com/IQ/american-express-using-ai-case-study/

[21] "How AI is Transforming Credit Risk Management?" - HighRadius https://www.highradius.com/resources/Blog/ai-in-credit-risk-management/

[22] "AI-powered Credit Decisioning Systems" - Capgemini https://www.capgemini.com/insights/research-library/ai-powered-credit-decisioning-systems/

[23] "How AI is Revolutionizing Credit Union Lending Amid Rising Delinquencies" - Zest AI https://www.zest.ai/learn/blog/much-ado-about-delinquencies/

[24] "Mobile Data + Machine Learning = Better Credit Scoring for the Underbanked" - Intellias https://intellias.com/mobile-data-machine-learning-better-credit-scoring-for-the-underbanked/

[25] "AI and Credit Scoring: Revolutionizing Risk Assessment in Lending" - AI Business https://aibusiness.com/finance/ai-and-credit-scoring-revolutionizing-risk-assessment-in-lending

[26] "AI-Driven Credit Risk Decisioning" - Experian Insights https://www.experian.com/blogs/insights/ai-driven-credit-risk-decisioning/

[27] "Mobile Data + Machine Learning = Better Credit Scoring for the Underbanked" - Intellias https://intellias.com/mobile-data-machine-learning-better-credit-scoring-for-the-underbanked/

[28] "AI Credit Scoring: The Future of Credit Risk Assessment" - LatentView Analytics https://www.latentview.com/blog/ai-credit-scoring-the-future-of-credit-risk-assessment/

[29] "The Top 20 Alternative Data Providers for Credit Risk Analysis" - Riskseal https://riskseal.io/blog/top-alternative-data-providers-that-serve-the-credit-industry

[30] "AI-powered Credit Decisioning Systems" - Capgemini https://www.capgemini.com/insights/research-library/ai-powered-credit-decisioning-systems/

[31] "Embracing generative AI in credit risk" - McKinsey & Company https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/embracing-generative-ai-in-credit-risk

[32] "Income & Employment Verification Services" - The Work Number https://theworknumber.com/solutions/products/income-employment-verification

[33] "AI in Lending Industry Guide: Use Cases, Impact and Challenges" - Docsumo https://www.docsumo.com/blogs/workflow-automation/ai-in-lending

[34] "The Future of Lending: Upstart's AI Advantage" - INO.com Trader's Blog https://www.ino.com/blog/2024/08/the-future-of-lending-upstarts-ai-advantage/

[35] "Our Story" - Upstart https://www.upstart.com/our-story

[36] "AI Case Study: AI-Powered Credit Scoring & Risk Assessment at Upstart" - Redress Compliance https://redresscompliance.com/ai-case-study-ai-powered-credit-scoring-risk-assessment-at-upstart/

[37] "Fintech - statistics & facts" - Statista https://www.statista.com/topics/2404/fintech/

[38] "AI in Finance Market Size, Share, Growth Report - 2030" - MarketsandMarkets https://www.marketsandmarkets.com/Market-Reports/ai-in-finance-market-90552286.html

[39] "AI in Lending Industry Guide: Use Cases, Impact and Challenges" - Docsumo https://www.docsumo.com/blogs/workflow-automation/ai-in-lending

[40] "AI in Lending Market Size, Share, Trends | CAGR of 23.5%" - Market.us https://market.us/report/ai-in-lending-market/

[41] "UK Lending Landscape Insights in 2024" - Fintech Market https://fintech-market.com/blog/uk-lending-landscape-insights-in-2024

[42] "The Impact of Fintech on Banking" - European-economy http://european-economy.eu/2017-2/the-impact-of-fintech-on-banking/?did=2043

[43] "First mover advantage: How Customers Bank partnered with a fintech" - Bank Automation News https://bankautomationnews.com/allposts/wealth/first-mover-advantage-how-customers-bank-partnered-with-a-fintech-to-gain-a-competitive-edge-over-larger-lenders/

[44] "The Future of Lending: Upstart's AI Advantage" - INO.com Trader's Blog https://www.ino.com/blog/2024/08/the-future-of-lending-upstarts-ai-advantage/

[45] "Our Story" - Upstart https://www.upstart.com/our-story

[46] "AI Case Study: AI-Powered Credit Scoring & Risk Assessment at Upstart" - Redress Compliance https://redresscompliance.com/ai-case-study-ai-powered-credit-scoring-risk-assessment-at-upstart/

[47] "AI Credit Scoring: The Future of Credit Risk Assessment" - Datrics https://www.datrics.ai/articles/the-essentials-of-ai-based-credit-scoring

[48] "AI credit scoring: Use cases and benefits" - Leeway Hertz https://www.leewayhertz.com/ai-based-credit-scoring/

[49] "Embracing generative AI in credit risk" - McKinsey & Company https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/embracing-generative-ai-in-credit-risk

[50] "How AI is Transforming Credit Risk Management?" - HighRadius https://www.highradius.com/resources/Blog/ai-in-credit-risk-management/

[51] "At BNP Paribas, Artificial Intelligence has entered a new dimension!" - BNP Paribas https://group.bnpparibas/en/news/at-bnp-paribas-artificial-intelligence-has-entered-a-new-dimension

[52] "BNP PARIBAS An AI Efficiency program" - Artefact https://www.artefact.com/cases/bnp-paribas-banking-on-an-ai-factory-as-the-heart-of-a-new-acceleration-program/

[53] "AI credit scoring: Use cases and benefits" - Leeway Hertz https://www.leewayhertz.com/ai-based-credit-scoring/

[54] "AI-powered Credit Decisioning Systems" - Capgemini https://www.capgemini.com/insights/research-library/ai-powered-credit-decisioning-systems/

[55] "AI-Powered Upselling & Cross-Selling: 2024 Guide" - Dialzara https://dialzara.com/blog/ai-powered-upselling-and-cross-selling-2024-guide/

[56] "AI-Powered Upselling & Cross-Selling: 2024 Guide" - Dialzara https://dialzara.com/blog/ai-powered-upselling-and-cross-selling-2024-guide/

[57] "AI-powered Credit Decisioning Systems" - Capgemini https://www.capgemini.com/insights/research-library/ai-powered-credit-decisioning-systems/

[58] "The promise of generative AI for credit customer assistance" - McKinsey & Company https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/the-promise-of-generative-ai-for-credit-customer-assistance

[59] "The Role of Artificial Intelligence in Income Verification" - Snappt https://snappt.com/blog/income-verification-ai/

[60] "Embracing generative AI in credit risk" - McKinsey & Company https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/embracing-generative-ai-in-credit-risk

[61] "The Role Of AI And ML In Transforming Credit Risk Management In Banking" - Avenga https://www.avenga.com/magazine/ai-for-credit-risk-management/

[62] "The promise of generative AI for credit customer assistance" - McKinsey & Company https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/the-promise-of-generative-ai-for-credit-customer-assistance

[63] "Credit Decisioning and AI: Past, Present, Future" - nCino https://www.ncino.com/news/credit-decisioning-artificial-intelligence-past-present-future

[64] "How to Use Alternative Data in Credit Risk Analytics" - FICO https://www.fico.com/blogs/how-use-alternative-data-credit-risk-analytics

[65] "Embracing generative AI in credit risk" - McKinsey & Company https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/embracing-generative-ai-in-credit-risk

[66] "Embracing generative AI in credit risk" - McKinsey & Company https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/embracing-generative-ai-in-credit-risk